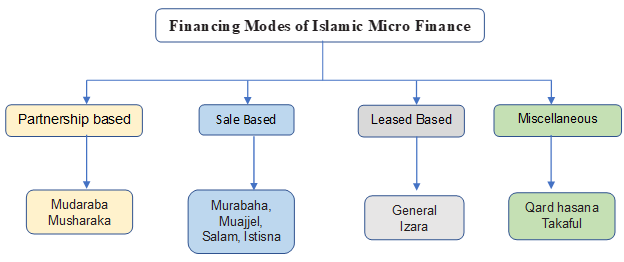

Instruments of financing may be broadly divided into

Musharaka involves investors injecting equity into a business venture and sharing any profits and losses from that venture according to predetermined ratios. Each partner retains (though is not obliged to exercise) management rights in the venture, must receive accounting and other information on business activity, must authorize the raising of capital from any new partners and may receive a salary in return for participating.

Mudaraba involves an investor or investors providing funding for a business venture and a manager with fiduciary responsibilities providing managerial or market specific expertise. Investors retain ownership of the assets but have no management rights. The investor and the manager share any profits according to predetermined ratios. The investor shares any losses according to their respective funding contributions

Murabaha involves a finance party purchasing tangible assets from a seller and selling them to a buyer at a predetermined profit margin. In the context of trade finance, the buyer will settle the marked-up purchase price by way of immediate lump sum payment. In the context of consumer finance, the buyer will settle the marked-up purchase price by way of deferred installments. Using a tawarruq structure and an asset for which there is a highly liquid market, the buyer will settle the marked-up purchase price by way of deferred installments but will also appoint the finance party as its agent to on-sell the assets on a spot basis and remit to the buyer the proceeds of any such sale.

Murabaha is the most popular and flexible Shari'a-compliant structure and is used in micro finance initiatives. However, it is costly to implement and a growing number of Shari'a scholars do not approve of it, especially intawarruq structure, on the basis that it is merely disguised lending where the participants have no interest in actually acquiring the underlying commodities. This applies all the more in the context of providing micro finance to start-ups and small companies whose businesses do not involve the sale and purchase of commodities and which do not have sufficient surplus funds to be credibly investing in commodities.

Ijara involves making available a known benefit arising from the use, possession and/or occupation of a specified asset in return for a payment. In the context of consumer financing, a finance party will purchase an asset from a client and lease it back to the client at a predetermined rate at predetermined intervals over a predetermined period of time. The finance party is responsible for maintaining and ensuring the asset (though may engage another (often the client) as its servicing agent) and the asset must exist for the duration of the lease. The financier may grant the client a sale undertaking and the client grant the financier a purchase undertaking, giving the client the option to purchase the lease assets for a pre-agreed residual sum at the end of or during the lease. It is also possible to structure the lease so that the leased asset is simply transferred to the client at the end of the lease.

Istisna involves the construction or manufacture and deferred delivery of specified made to-order assets of predetermined quality and quantity in return for installment or lump sum on delivery payments. The manufacturer must procure his own goods but, unless those goods do not conform with the contracted terms, the contract is irrevocable after the commencement of manufacture.

Salam involves one party making an upfront payment to another party for the future delivery of assets of predetermined quality and quantity. The contract is irrevocable after the payment of the purchase price. Although not accepted in many jurisdictions, in a parallel salam structure, the finance party will enter into a parallel but unrelated contract to on-sell the assets on delivery at a profit. However, salamis costly to implement and, in the context of forward crop-financing in agrarian societies, it covers little more than production costs and it is the financiers rather than the clients that realize any potential gains at (post-harvest-season and post asset-delivery) market maturity.

Charitable loans free of interest and profit-sharing margins, repayment by installments. A modest service charge is permissible.

| SN | Islamic Mode of Financing | Underlying Islamic Mode |

|---|---|---|

| 1 | Musharaka (Partnership) | Musharaka |

| 2 | Mudaraba (Trust Financing) | Mudaraba |

| 3 | Murabaha (Cost-Plus Mark-Up) | Murabaha |

| 4 | Ijara (Sale and Leaseback) | Ijara |

| 5 | Istisna (Construction / Manufacturing) | Istisna |

| 6 | Salam (Future Delivery) | Salam |

| 7 | Qard Hasan | Qard Hasan |

These are deposits or accounts deposited with the institution by clients for using them in daily transactions, whether by direct cash withdrawal or by checks. Current accounts differ from savings and investment accounts in that the formers are guaranteed by the HMFI, and therefore the holders do not deserve a return on them, and they are usually intended for money saving and obtaining other financial services. On the other hand, the investment and saving accounts are not guaranteed by the institution and are intended for saving as well as investment, and their holders receive a return on them.

These are deposits or accounts deposited by the clients with the institution to invest them on Mudaraba. They are classified into brackets of different amounts and maturities, and typically invested in the Mudaraba pool, where they deserve a share in the pool’s profit under their total volume and duration of investment in the pool